The blacklist: When will China pull the trigger?

China's new Unreliable Entity List seems to be an echo of US actions. But while the list looks like a potentially lethal tool, it has to be wielded prudently in order not to hurt China's economy or cause anxiety. Zaobao correspondent Yang Danxu examines the factors involved.

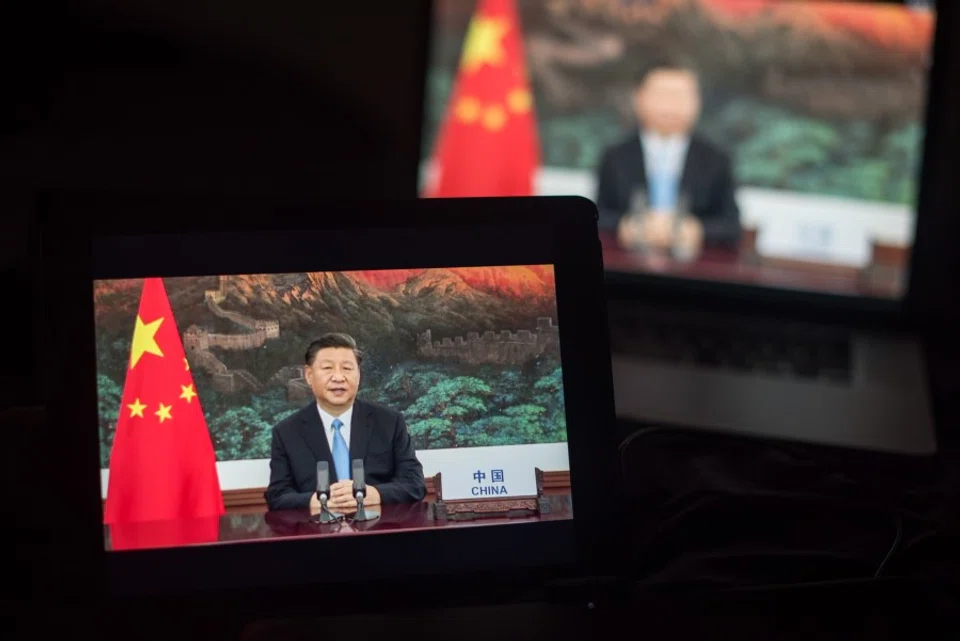

Following the release of an Unreliable Entity List by China's Ministry of Commerce last Saturday, a fellow journalist from China said in private: "The gun is loaded."

The biggest question now is who the gun is aimed at and when the trigger will be pulled. From the information quoted in the media over the past few days, the first "target" might not be a US company, but Britain's HSBC.

While HSBC has actively made positive overtures to Beijing on the Hong Kong issue, Beijing will want to settle scores when it comes to Meng Wanzhou.

Amid China-US competition, HSBC is stuck in the middle. Since the arrest of Huawei CFO Meng Wanzhou in Canada, key player HSBC has come under fire in China. In July this year, Chinese state media strongly criticised HSBC for its "unsavoury" part in the case with its "malicious actions and fabrication of evidence".

While HSBC has actively made positive overtures to Beijing on the Hong Kong issue, Beijing will want to settle scores when it comes to Meng Wanzhou. On 21 September, HSBC's share price fell to their lowest since 1995 - while reports of HSBC's involvement in money laundering was probably a factor, obviously the market is also worried that HSBC might be blacklisted.

The Global Times, which revealed HSBC's possible blacklisting, also mentioned US courier company FedEx.

Last year, a "sorting error" by FedEx led to Huawei packages intended to go from Japan to China ending up in the US instead. Public sentiment held that such a "calculated error" was meant to back up the Trump administration in hitting out at Huawei. Chinese state media called for sanctions on FedEx, while CCTV wrote threateningly in a commentary: "FedEx, get to know the Unreliable Entity List."

The US has many companies in China, and there are many candidates to choose from to impose sanctions. But whichever companies are chosen, there will be fears of repercussions.

Blacklisting companies following disagreements has become a new strategy in international geopolitical competition. In the intense competition between China and the US over the past couple of years, the US has blacklisted and imposed sanctions on quite a few China companies on the basis of national security and human rights, with about 150 companies on a US blacklist just for having business dealings with Huawei.

Tit-for-tat blacklist

China is clearly mimicking the US in coming up with its blacklist, so that it has a basis for future retaliation against the US. However, this new tool is a headache to use. The US has many companies in China, and there are many candidates to choose from to impose sanctions. But whichever companies are chosen, there will be fears of repercussions.

While it is possible to blacklist Apple Inc. - doing so would definitely deal a big blow to the US - it is nonetheless the "nuclear option".

First, China has to balance retaliation against the US with making sure that there is no irreparable impact on its own economy and industries, and not causing anxiety among foreign companies in China.

Take Apple Inc for example. In the recent hooha over the US's ban on TikTok and WeChat, there have been occasional calls on the Chinese internet urging officials to target Apple. While it is possible to blacklist Apple Inc. - doing so would definitely deal a big blow to the US - it is nonetheless the "nuclear option". Under added pressure from the need to stabilise the economy and job market, China, which handles a large bulk of Apple's original equipment manufacturer (OEM) business, should avoid causing a lose-lose situation unless absolutely necessary.

Additionally, Beijing must avoid imposing overly stringent measures on US enterprises that possess technology that cannot be easily replaced. Academics point out that China is in urgent need of technology at present. Thus, it should welcome US high-tech enterprises, especially those that do not compete with Chinese enterprises, instead of casting them out.

China will need to think twice before pulling the trigger

A day after the Chinese Ministry of Commerce released the Unreliable Entity List, it reassured foreign enterprises and clarified that the list is only targeted at a very small number of foreign entities that violate market rules and Chinese law.

More importantly, Beijing must think about how it should respond to extreme pressure from the US without actively pushing China-US relations to the brink of collapse.

China-US relations sharply deteriorated over the past two years as a result of the trade war. Ironically, it is also the economy and trade that can maintain China-US relations now. While the US is closing in on China and striving to cut ties with China in all aspects, both countries are highly interdependent in the areas of economy and trade. A China-US decoupling is not only very difficult, it is extremely unimaginable. Vigorously attacking US enterprises in China is tantamount to hastening their exit from the Chinese market and reducing the weight of the "ballast" that balances China-US relations.

...entities at higher risk will be those that offer products that have a close Chinese competitor or US companies that are involved in arms sales to Taiwan.

Of course, the "blacklist" is not merely just for show - it is expected that Beijing will use it as a deterrent. Michael Hirson, the practice head of China and Northeast Asia at Eurasia Group, thinks that Beijing will likely add at least one US company to the list before the year is out but be circumspect in the way it uses the instrument. Furthermore, entities at higher risk will be those that offer products that have a close Chinese competitor or US companies that are involved in arms sales to Taiwan.

Apart from this, whether Beijing will announce the companies in the list before the US presidential elections takes place remains a question. Agitating US President Donald Trump, who has been playing the "China card" during his campaigns, would potentially escalate already tense China-US relations. Waiting for US policy toward China to stabilise would not only keep China-US relations from being crippled during the current sensitive period, but leave room for China-US relations to improve. That is why, even if the gun is loaded, it is still best to go slow on pulling the trigger.

Related: Amid the pandemic, is the China-US tech war firing up again? | Will China and the US fight another wrong war, with the wrong enemy, at the wrong place and time? | Banning TikTok and WeChat: Is the US afraid of competition? | Banning TikTok: A 'China Crusade' has begun? | Meng Wanzhou: Your warmth lights my path

![[Photos] Fact versus fiction: The portrayal of WWII anti-Japanese martyrs in Taiwan](https://cassette.sphdigital.com.sg/image/thinkchina/3494f8bd481870f7c65b881fd21a3fd733f573f23232376e39c532a2c7593cbc)