How can China escape the middle-income trap?

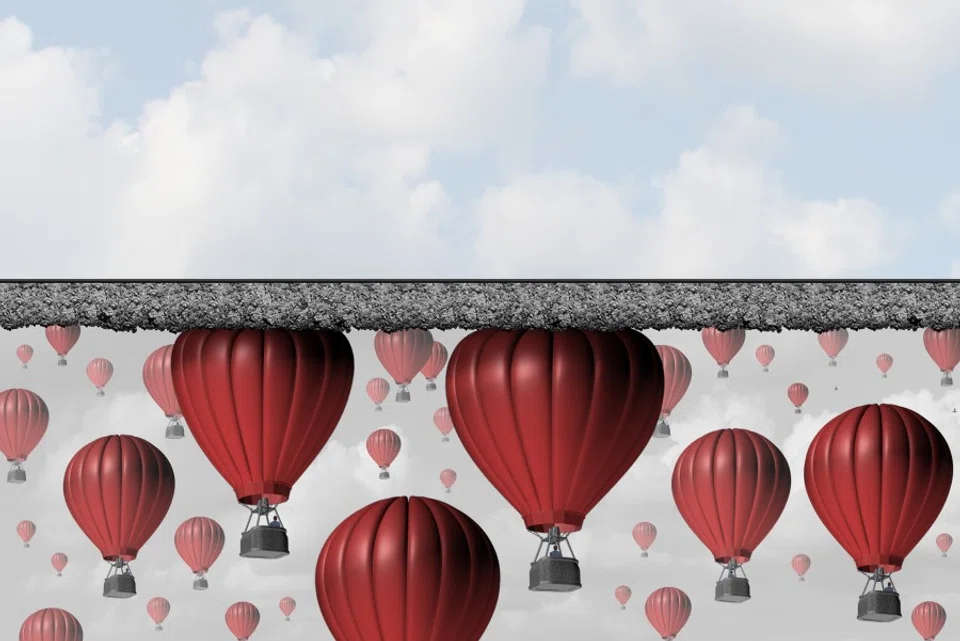

History tells us that avoiding the middle-income trap is not easy. According to Zheng Yongnian, since World War II, very few middle-income economies have successfully become high-income economies. Most economies stagnate, unable to compete with low-income countries in labour costs or with rich countries in cutting-edge technological research and development. How can China save itself from the middle-income trap?

After an economy develops and becomes a middle-income economy (GDP per capita of US$3,000), two outcomes may occur. First, it gradually and sustainably develops into a developed economy; second, disparity between the rich and the poor, environmental degradation and social unrest ensue, resulting in economic stagnation.

Generally, the latter outcome is referred to as the "middle-income trap". Historically speaking, avoiding it is not easy. Since World War II, very few middle-income economies have successfully become high-income economies. Many economies often stagnate, unable to compete with low-income countries in labour costs or with rich countries in cutting edge technological research and development.

Apart from Israel in the Middle East, the economies that are widely recognised to have avoided the middle-income trap are mainly Japan and the "four little dragons" of South Korea, Singapore, Hong Kong and Taiwan in East Asia. Among them, Japan and South Korea are the only larger economies that have developed into high-income economies.

Japan's GDP per capita was nearly US$3,000 in 1972 and exceeded US$10,000 in 1984. South Korea's GDP per capita was over US$3,000 in 1987, grew to US$11,469 in 1995 and reached US$28,101 in 2014. Japan and South Korea made the transition from middle income to high income in 12 years and eight years respectively.

Middle-income trap the rule, rather than exception

These economies are exceptions because we mostly see economies falling into and staying in the middle-income trap. In Southeast Asia, the GDP per capita of the Philippines was US$684.60 in 1980, and only US$2,865 in 2014. Factoring inflation, income per capita has not changed significantly. Similarly, Malaysia's GDP per capita was US$1,812 in 1980, and only US$10,804 in 2014.

In Latin America, Argentina's GDP per capita exceeded US$1,000 in 1964 and increased to over US$8,000 in the late 1990s, but fell to US$2,000 in 2002 before rising to US$12,873 in 2014. Mexico was already a middle-income country in 1973, with a GDP per capita of US$1,000. 41 years later, in 2014, it was still only an upper-middle-income country with a GDP per capita of US$10,718.

Despite decades of effort, there are many similar Latin American countries that have not exceeded the GDP per capita threshold of US$15,000 to become developed countries.

Optimist vs pessimist views of the middle-income trap

Generally, there are many contributing factors to the middle-income trap, in which these economies find themselves. These include missed opportunities to transform development models, failure to overcome technological and innovation bottlenecks, insufficient emphasis on equitable development, missteps in macroeconomic policies, and serious delays in implementing structural changes.

China has had heated debates that have thrown up two opposite and extreme views about whether it will fall into the middle-income trap. Optimists believe that China has no risk of falling into, or has already avoided, the middle-income trap. Pessimists, however, believe that China faces this risk and, in many aspects, has already fallen into the trap.

Objectively speaking, although the current discussions are less intense than a few years ago, the issue persists. In the ever-changing and worsening internal and external economic environment, China has even more reason to confront and discuss this issue.

China's GDP per capita of about US$10,000 is far below that of Taiwan (US$25,000), the fourth of the four little dragons. In a vast country such as China, with regions in various stages of developments, income distribution discrepancies are significant among various social groups. Even if China's overall GDP per capita exceeds that of the middle-income economies, many of its regions and social groups are likely to be caught in the middle-income trap and show signs of its resultant social impacts. Therefore, China needs to pursue not only GDP per capita, but more importantly an economic growth that is more equitable.

Ignoring enterprises will worsen middle-income trap

However, the discussions thus far in China are flawed in several aspects.

First, the discussions have focused on the government but not enterprises. In other words, the overemphasis of the country's macroeconomic policies, especially on the effects of policies relating to industries, has neglected and ignored the role of enterprises. Although industrial policies can transform or upgrade enterprises, they must take into account the actual needs of enterprises.

Enterprises need the government's effective provisions, not what the government envisages or plans to provide. Imposing the government's wishful provisions is fatal for enterprises because the mainstay of the economy is not the government itself but the enterprises, including state-owned enterprises. Moreover, as the current analyses of national macroeconomic policies are "overly macro", they fail to reveal the linkages between upstream and downstream factors in economic development, as expounded by political economist Albert Hirschman.

In other words, apart from policy rent-seeking, it is unclear how the country's macroeconomic policies on enterprises aid in avoiding the middle-income trap, a microeconomic behaviour. From this perspective, one must venture beyond the government's policies to explore the role of enterprises to aid a country in this endeavour. Regardless of the government's good intentions at the outset, focusing solely on the government and ignoring enterprises will accelerate the country's descent into the trap.

How did developed countries maintain economic stability

Second, there has also been an overemphasis on studying the economies that have already fallen into or have avoided the middle-income trap. While this is important, it will be more instructive to look into the stability of economic development of developed Western countries.

Since World War II, most of the developed countries have experienced various economic crises, such as the energy crisis in the 1970s and the global financial crisis in 2007-2008. In recent years, most developed countries are also facing political crises of a populist nature. Nevertheless, economic development in developed countries remains stable, unlike that in developing countries which fluctuates significantly.

During the 1997 Asian financial crisis, the political revolution in Indonesia - a developing country - wiped out decades of development overnight. On the other hand, Japan - a developed country - has been in economic malaise since the bursting of its asset price bubble in the early 1990s, in what has been termed the "Lost Decade" and the "Lost Two Decades". Despite economic stagnation, however, Japan's socio-economic development continued and its GDP per capita has not fallen by much. In stark contrast to developing economies, this points to the greater significance for China to study how developed countries maintain their levels of development, so that it may avoid the middle-income trap.

Middle-income trap a problem of wealth creation and distribution

The middle-income trap is ultimately a problem of wealth creation and distribution. Developed countries are often typically capitalist. Instead of the government, the wealth creators in these countries are the enterprises which also maintain the countries' high levels of economic development. In the past decades of globalisation, enterprises in developed countries have played this crucial role in their respective societies.

While the Chinese government has a formidable ability to mobilise for wealth distribution, it does not possess the same ability to create wealth.

In terms of wealth creation, there are no serious problems with the economic system and the structure of enterprises in developed countries. Instead, the problem lies in the political system, resulting in massive problems in wealth distribution. The immense wealth created by enterprises remains in the hands of a small number of people, and the government is unable to effectively allocate the newly created wealth to achieve a fair society.

Today, the main problem that China faces is wealth creation, not distribution. While the Chinese government has a formidable ability to mobilise for wealth distribution, it does not possess the same ability to create wealth. As enterprises are the wealth creators, China needs to learn how developed countries create wealth through enterprises.

How do developed countries continue being economically developed? First, they maintain an advanced level of technology. Currently, most of the core technologies reside in the hands of Western developed countries, even though technology transfer has occurred via globalisation to developing countries. The main structural reason for the protection of core technologies is to maintain the competitiveness of enterprises. Another reason used by developed countries is national security.

This gives rise to antitrust laws in order to maintain the openness of an economy, both externally and internally, so as to enable new types of enterprises to emerge. Otherwise, in a monopoly, it will be difficult to segregate politics from business. This will, in turn, lead to an economy that encourages two-way rent-seeking between enterprises and the government or its officials.

Second, the relationship between the government and the workforce is intended to maintain a balance between capital and labour, while growing the pie and distributing it. To satisfy the people and demonstrate their legitimacy in governance, the governments of democratic and socialist countries alike tend to lean towards distributing the pie. Similarly, to enjoy the wealth that they are entitled to, the people (workers) want a share of the capital and wealth. So, the intentions of the government and the people for distributing the pie are consistent. However, a balance must be struck between growing and distributing the pie, to provide the motivation to put capital to good use. Although the governments of developed countries also face the pressures of providing for their welfare societies, they managed to find a balance. This explains why the West retains high-quality capital and core technologies.

Avoiding the middle-income trap

More importantly, developed countries have created favourable local conditions to entrench capital and facilitate capital flow. Despite the current myriad of problems faced by the West, leakage of high-quality capital has not occurred. The severe problem of wealth distribution affects only the lower echelons of society while the upper strata, the true rulers of society, remain unscathed. The upper-middle and middle classes, who also wield capital and technologies, continue to cooperate to enjoy the benefits that capital brings.

Local conditions include the establishment of complete industrial value chains, education and training frameworks, and the supply of skilled workforce. Unlike capital, these are "immovable" and cannot be "displaced". In fact, advanced technologies and high-quality capital are tied to these local conditions which are created by the capital itself, such as universities and institutes of technology. Despite globalisation, the West has lost none of its core economic and technological activities. This is also the reason for the West maintaining its leadership or slowing down its decline.

In developed countries, political parties with economic management experience are elected to power. While populist parties may win elections, they will be short-lived if they are unable to effectively govern due to the lack of such experience and ability.

Having borne the costs of issues such as the environment, human rights and others, developing countries cannot sustain economic development because they are unable to attract or retain high-quality capital. This is a vicious circle.

Many other developed economies, especially Japan and the four little dragons, are also relying on enterprises to avoid the middle-income trap. This is demonstrated in their past achievements and in the problems they face today. Taiwan and Hong Kong are confronting problems of both the government and enterprises. Conversely, Japan, South Korea and Singapore can attribute their success to the effective coordination between the government and enterprises.

The predicaments of many developing countries stem from the outflow of capital to developed countries. Low-tech capital, such as labour-intensive capital, flows from developed to developing countries, whereas the best technical capital flows in the opposite direction. Having borne the costs of issues such as the environment, human rights and others, developing countries cannot sustain economic development because they are unable to attract or retain high-quality capital. This is a vicious circle.

As quantitative economic growth in China has been maximised, qualitative economic growth that relies on high-quality capital and technologies is undoubtedly the means to avoid the middle-income trap. China must establish and localise numerous high-end industrial value chains to counter the threat of rapid outflow as external circumstances change. Although the Pearl River Delta Economic Zone has established a complete industrial value chain, it remains focused on labour-intensive technologies due to a lack of effective upgrading.

Fortunately, Shenzhen is now rapidly developing an industrial value chain centred on high-end technologies and high-quality capital, which is expanding to the surrounding areas. If the Greater Bay Area, Hangzhou Bay New Zone, Yangtze River Economic Belt, and Beijing-Tianjin-Hebei Region can establish their respective unique industrial value chains, China will be able to retain its high-quality capital and attract high-quality foreign investments. This will undoubtedly help China escape the middle-income trap, develop into a high-income economy and maintain stable economic development.

This requires cooperation between the Chinese government and enterprises. The government must deftly manage industrial relations to achieve a balance between growing and distributing the pie. More important for the enterprises is to strengthen the rule of law, which simply put is order based on rules. Rules are necessary for technological innovation and intellectual property protection, the creation and protection of wealth, and the growth and flow of capital.

To avoid the middle-income trap and achieve a developed economy, the Chinese government should explore the needs at the level of individual enterprise and determine what and what not to do when helping enterprises. Effective policies will emerge from careful observation and clear thinking, and the middle-income trap will be circumvented.

![[Photos] Fact versus fiction: The portrayal of WWII anti-Japanese martyrs in Taiwan](https://cassette.sphdigital.com.sg/image/thinkchina/3494f8bd481870f7c65b881fd21a3fd733f573f23232376e39c532a2c7593cbc)