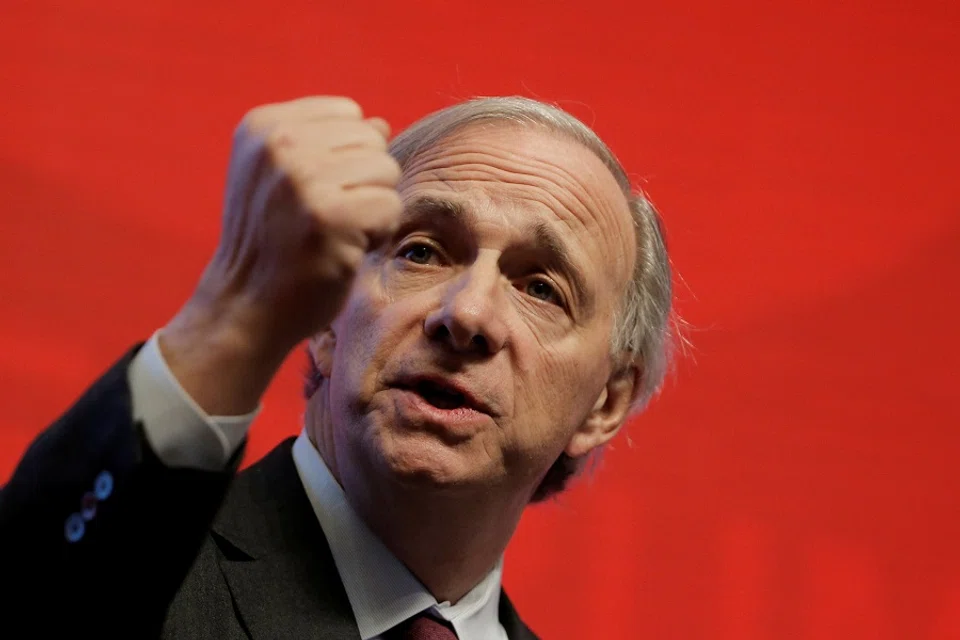

Ray Dalio at the China Development Forum: What can history tell us about the rise of China?

Ray Dalio, founder, co-chief investment officer and co-chairman of Bridgewater Associates, spoke with Lu Mai, vice chairman of the China Development Research Foundation and secretary general of the China Development Forum (CDF), on 8 June 2020. Drawing from patterns and cycles that he observed from history, his talk focused on global economic trends and how the pandemic would shape the world. He also gave his opinions on China-US cooperation and competition, and gave suggestions as to how the two great powers can work together for the greater good of the world.

Amid great uncertainty in a post-pandemic world and major blows to the world economy, 70-year-old Ray Dalio, founder, co-chief investment officer and co-chairman of Bridgewater Associates, identified three big issues of our time which account for much of the uncertainty and conflict we see in the world today. These are:

(1) the end of the long term debt cycle;

(2) the wealth and political gaps in societies; and

(3) the rise of a great power (China) to challenge the existing great power.

During this time, he has seen China's per capita income rise by 22 times, its poverty rate fall from 88% to under 1%, and its share of the world's GDP increase from 2% to 22%.

Although the impact of Covid-19 was at the top of everyone's minds, Dalio spent the first half of his talk providing a much-needed historical context by describing the rise and fall of empires since the 1500s. He said China was the most powerful empire in the world in the 1500s when it was at its peak of development during the Ming dynasty. Although other empires such as the Spanish, Dutch, and the British empires, rose and fell during the next few hundred years and changed the world order, there was little interaction between empires of the East and West in the past.

However, when the American and British empires were the dominant powers during the 1930s to 1940s, and when rising powers of Germany and Japan tried to challenge them, wars broke out across the world. The war ended with both rising powers conceding defeat and the world then entered its present order in 1945.

China's rise after the 1500s

On China's re-emergence as a rising world power, Dalio said he has witnessed many important milestones in China's rise over the past 35 years that he has been visiting the country. During this time, he has seen China's per capita income rise by 22 times, its poverty rate fall from 88% to under 1%, and its share of the world's GDP increase from 2% to 22%.

Dalio further said that a country's rise can be tracked by eight measures of power, namely, education of the people, innovation and technology, competitiveness in the world markets, military, extent of world trade, economic output produced, development of the financial centre as a means of allocating capital and resources, and reserve currency status.

Dalio thinks that out of these eight measures, education is the most important, and this is "not only 'formal education' in terms of understanding math, science, history, but the education of a people to be civil, to be good citizens, and to behave in a responsible way". He believes that the improvement of education is the most fundamental factor in creating a better society. Once achieved, innovation and technology are set to follow.

...transition periods between changing world orders had always been difficult in history, and often occur later in the long-term debt cycle.

The typical changing world order and debt cycle

Dalio noted that transition periods between changing world orders had always been difficult in history, and often occur later in the long-term debt cycle.

These transitions are typically marked by large wealth gaps, internal conflicts leading to revolutions which could be peaceful or violent, large transfers of wealth from the haves to the have-nots, and big currency breakdowns. The rising power's challenge of the existing power may lead to war, and ultimately, the establishment of the new order.

After the transfer of power, usually after a period of war, the world enters a typical cycle. There is a dominant power that nobody wants to fight, and people want peace and prosperity after a period of chaos. This will, however, also lead to the development of debt and capital markets in order to finance the society that people so desire. According to Dalio, when these actions are "overdone", a large wealth gap and a large economic bubble will be formed. He said, "When there is a downturn, there is a debt bust - the bubble bursts - and inevitably that creates a credit crisis."

Currently, the top 0.1% of the population in the US has a net worth that is nearly as much as the bottom 90% combined - a wealth gap that is the "largest since the 1930s".

We are at the end of a long-term debt cycle

Dalio observed that the present world is at the end of this long-term debt cycle. Facing a weakened economy, central banks are responding to the situation by printing money, bringing interest rates down, buying financial assets and pushing these into the market.

In a typical cycle, a period of conflict follows when such measures prove ineffective. He said there would be "revolution or wars of some sort" that would lead to a change and restructuring of the system, and the creation of the next world order.

Dalio said that the level of "unfair economic gaps" we are seeing now is at its highest since the 1930 to 1945 period, and it is also comparable to that period.

Currently, the top 0.1% of the population in the US has a net worth that is nearly as much as the bottom 90% combined - a wealth gap that is the "largest since the 1930s". Similarly, the income gap also shows that the income of the top 10% is equivalent to about the bottom 90% of the US population. He added that while he had focused his talk on the US, the same situation is happening around the world.

He believes that wealth and income gap issues have brought about populism and have resulted in a "political division" that is "bigger and more intransigent" than before.

He estimates that approximately US$23 trillion worth of losses will be incurred globally as a result of the pandemic.

Covid-19 as the stress test of the cycle

Against this backdrop, the Covid-19 pandemic, is what Dalio calls "a stress test".

He estimates that approximately US$23 trillion worth of losses will be incurred globally as a result of the pandemic. Calling the pandemic a "tsunami", he said that its after-effects will be keenly felt for a long time to come. In terms of the decline in GDP and the rise in unemployment rates, Dalio thinks that the situation is "comparable to that of the Great Depression and will be much greater than that in 2008".

Commenting on the post-pandemic economic situation, Dalio anticipates fundamental changes in how the world approaches capitalism and globalisation.

Dalio believes the world will also move from an era marked by globalisation into one of self-sufficiency.

He said capitalism as we know it will be changed because of a "structural inability to use interest rates to stimulate monetary policy". While economies have relied on central banks to buy financial assets such as bonds and counted on the system to distribute them in an effective way, this system has failed to get money and credit to the people who need it the most. Hence, there will be a re-examination of how wealth should be divided, how the rich-poor gap in society should be narrowed, and ultimately, how a better system could be forged and worked towards in a bipartisan way.

Dalio believes the world will also move from an era marked by globalisation into one of self-sufficiency. Systems will be restructured by way of greater polarisation. Enterprises will no longer focus solely on finding the best and most efficient way of production around the world in an open, free trade. Instead, countries will have to confront situations where production independence generates tensions between states.

He advised investors to diversify their investment portfolios in terms of currency, countries and types of assets during such unstable times.

Humanity needs to work for the greater good

On the recurring question of economic inequality, Dalio believes that the solution for inequality is essentially a test of "human nature" and if humanity can rise above themselves to come together for the greater good. He said with creativity and inventiveness, the economic pie can be grown in both the domestic and world systems, if it is well-run and well-divided, and if people possess the spirit of "generosity and mutual understanding".

The alternative is to fight through wars and revolutions, and history has shown us that humanity will pay a high price if it goes down that path. Hence, the question to ask is whether individuals and parties "can rise above themselves or will they fight for wealth and power in the way that they have fought throughout history".

On China-US relations, Dalio said while it is difficult to fight destiny, both sides need to recognise the challenges of each other, negotiate well, and in the end, try to help each other and be more comforted about their fears. The aim will be "to create a roadmap for successful mutual development with cooperation". Such a path, although challenging to achieve, will ensure that major conflicts and hot wars are avoided. He added, "The advice will be to keep emotions down, thoughtfulness up, and to look at the greater purpose."

Editor's note:

Ray Dalio is an American billionaire and philanthropist who is the founder, co-chief investment officer and co-chairman of Bridgewater Associates, the world's largest hedge fund firm. The firm has about US$136 million under management as of January, according to a report by Institutional Investor.

Lauded for his industry-changing innovations, Dalio built Bridgewater using a principled-based approach, applying standard ways to deal with situations that occur over and over. His set of principles became the framework for the firm's management philosophy and were captured in the TED Talk "How to Build a Company Where the Best Ideas Win" and published in a bestselling book, Principles: Life and Work, in 2017. His forthcoming book due September 2020 is The Changing World Order: Why Nations Succeed and Fail.

The China Development Forum is a platform for discussion on the latest issues affecting China, sponsored by the Development Research Center of the State Council of China and organised by the China Development Research Foundation. In May 2020, it held an online "CDF Talk" programme where it sought views from eminent businessmen across the globe. These video chats were released on their Facebook page in June, starting with the first episode with Ray Dalio, founder, co-chief investment officer and co-chairman of Bridgewater Associates.

The above summary was put together by ThinkChina based on Ray Dalio's talk at the China Development Forum's online 'CDF Talks'.

![[Photos] Fact versus fiction: The portrayal of WWII anti-Japanese martyrs in Taiwan](https://cassette.sphdigital.com.sg/image/thinkchina/3494f8bd481870f7c65b881fd21a3fd733f573f23232376e39c532a2c7593cbc)