China’s stock market a bright spot as Asia’s market tumbles

Lianhe Zaobao journalist Li Kang speaks with analysts to find out why Chinese stocks and currency are still performing well amid the Asia-Pacific stock market crash the past week.

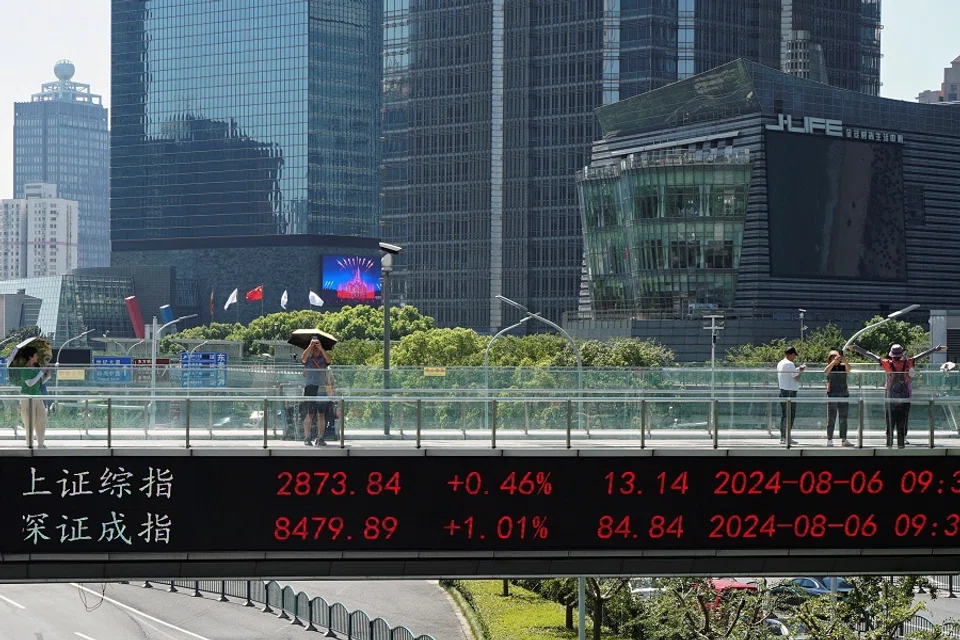

As Asia-Pacific stock markets tumbled across the board on 5 August, Chinese shares unexpectedly resisted the sharp decline and closed with only a modest drop.

Analysts believe that amid a weakening US dollar and uncertain global capital markets, foreign capital could return to the Chinese market. However, investors will remain cautious and carefully evaluate China before entering the market.

Chinese stocks and currency going against the trend

Affected by the global stock market sell-off, Japanese and South Korean shares plummeted on 5 August. Japan’s benchmark Nikkei 225 index plunged a record 12.4% while South Korea’s benchmark KOSPI stock index tumbled 8.8%, the biggest fall since 2008.

However, China’s three major A-share indices showed an opposite trend on the same day — the benchmark Shanghai Composite Index was up 0.07% in the morning; the Shenzhen Component Index up 0.37% and the GEM index up 0.42%. The three indices retracted their gains and declined after the stock market crash, falling between 1.54% and 1.89% in the afternoon, although it was still less severe than in other Asia-Pacific markets.

Tommy Xie, head of Greater China Research & Strategy at OCBC Bank, told Lianhe Zaobao that the decline in the Chinese stock market is relatively smaller on the one hand because the mainland Chinese and Hong Kong markets were undervalued during the sector rotation over the past week and held some intrinsic value. On the other hand, the Chinese stock market has already experienced a considerable amount of selling this year, making it less likely to see a significant further decline.

After the Shanghai Composite Index surpassed 3,000 points in late February, it dropped below 3,000 again in June and remained low, closing at 2,860.7 points on 5 August, essentially erasing its gains over the past six months or so.

Xie pointed out that after the Chinese central bank cut interest rates in late July, the renminbi did not depreciate but instead appreciated by over 1% since August, led by the weakening US dollar and the unwinding of yen carry trades. This also helped to ease market sentiments.

... under the current relatively loose liquidity conditions, funds may seek other markets in response to adjustments in the US and Japanese markets, with mainland China and Hong Kong as one of the targets. — Tommy Xie, Head, Greater China Research & Strategy, OCBC Bank

The RMB exchange rate against the US dollar has been rising over the past two weeks, and continued to surge on 5 August after the US stock market opened, with the US dollar reaching 7.0947 against offshore RMB at one point, the highest since December last year.

China’s assets show value for money

On 5 August, the China Securities Journal quoted analysts saying that China’s assets are now showing value for money and are expected to attract overseas funds to flow back.

The Paper also quoted Ping An Securities, noting that against the backdrop of increased volatility in overseas risk assets, the Chinese market is benefiting from the intensification of domestic policies and improvement of liquidity expectations, making it relatively attractive.

OCBC’s Xie analysed that under the current relatively loose liquidity conditions, funds may seek other markets in response to adjustments in the US and Japanese markets, with mainland China and Hong Kong as one of the targets. The performance of mainland China’s stock market could also attract the return of funds.

However, Xie pointed out that this is just the first step, and subsequent developments will depend on specific conditions such as China’s economic fundamentals and the overall environment. As for how much funds will flow back, investors will also consider factors such as geopolitics.

Following the Chinese State Council’s announcement of “20 key tasks” to boost consumption in the service sector on 3 August, the major consumption sector surged on 5 August, with education, games, liquor, sports and tourism leading the gains.

... the Chinese authorities’ focus on promoting consumption in the service sector is clear and will provide some support to the sector, with the rise in major consumption partly showing a positive response to official policies. — Xie

Xie said that the Chinese authorities’ focus on promoting consumption in the service sector is clear and will provide some support to the sector, with the rise in major consumption partly showing a positive response to official policies.

Meanwhile, Chinese netizens are not convinced by the performance of A-shares, which have not been affected by the Asia-Pacific stock market crash. The topic was trending on social media on 5 August, but most netizens were lamenting the stock market’s prolonged slump.

This article was first published in Lianhe Zaobao as “中国股市意外抗住剧烈跌势 分析:海外资金或回流中国市场”.