US expands trade dispute to China’s shipbuilding sector

The mounting pressure on China extends beyond the digital realm and into manufacturing, especially in areas involving critical technologies such as semiconductors and electric vehicles. The US then intensified its focus on maritime security, which included directives aimed at China’s shipbuilding industry.

(By Caixin journalists Li Rongqian, Du Zhihang and Denise Jia)

The US last month began an investigation of China’s dominant shipbuilding industry, in a move signalling increasing pressure on China that extends beyond technology and into the manufacturing sector.

Following a petition from five labour unions, Katherine Tai, the US trade representative (USTR), announced on 17 April the so-called 301 probe into China’s practices in maritime equipment, logistics and shipbuilding. A public hearing is set for 29 May. This marks the first industry-specific investigation by the Biden administration under Section 301 of the US Trade Act of 1974 — a tool that allows the government to enforce trade agreements and impose sanctions on nations violating norms of international commerce.

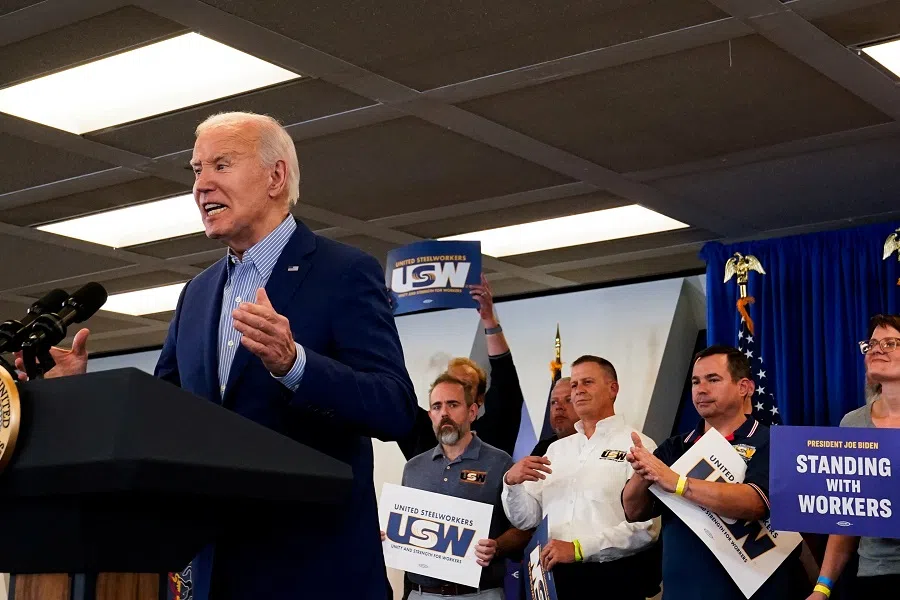

Speaking from the United Steelworkers headquarters in Pittsburgh on the day of the announcement, President Joe Biden called on Tai to consider tripling the tariff on Chinese steel and aluminum pending the conclusion of a four-year review. He also emphasised the importance shipbuilding to national security and that his administration takes seriously the unions’ petition concerning whether China’s government is using anticompetitive practices to enable the country’s shipbuilders to artificially lower prices.

“We’ve heard you,” Biden said. “And if the Chinese government is doing that and the unfair tactics to undermine free and fair trade competition in the shipping industry, I will take action.”

China “firmly opposes” the investigation, which is a “mistake on top of a mistake,” the Ministry of Commerce said in a statement.

“The petition misinterprets normal trade and investment activities as damaging to US national security and corporate interests, and blames China for US industrial issues, lacking factual basis and running counter to common sense economics,” the ministry said.

The mounting pressure on China extends beyond the digital realm and into manufacturing, especially in areas involving critical technologies such as semiconductors and electric vehicles.

As 2024 ushers in a more assertive US stance towards China, the landscape of economic and trade disputes has intensified with a series of accusations, investigations and sanctions. The latest crackdown targets TikTok, the Chinese-owned popular social media and video platform. A bill Biden signed into law will require a sale of TikTok by its parent company ByteDance within 270 days or impose a US ban of the app.

The mounting pressure on China extends beyond the digital realm and into manufacturing, especially in areas involving critical technologies such as semiconductors and electric vehicles. On 21 February, the White House intensified its focus on maritime security, with Biden empowering the Department of Homeland Security to combat cyber threats specifically in the maritime domain. This included directives aimed at Chinese-made ship-to-shore cranes, which dominate nearly 80% of the market at US ports and are alleged to pose significant cybersecurity risks.

Amid these tensions, Chinese state-owned Shanghai Zhenhua Heavy Industries Co. Ltd., the world’s leading port crane manufacturer, finds itself at the center of a geopolitical storm. A US congressional investigation alleged some Chinese-made cranes at US ports contain undocumented cellular modems, an accusation the company denies.

Minimal short-term impact

The investigation into China’s shipbuilders isn’t expected to impact the industry in the short-run as companies have production scheduled for the next three to four years, a senior shipbuilding executive told Caixin. But the long-term implications of the geopolitical tensions could severely harm production, sales and investments of Chinese enterprises, he said.

Yang Jianrong, a senior adviser to the Shanghai government, highlighted the escalating complexity of Sino-US trade disputes to Caixin, noting a shift from localised issues to broader, more aggressive administrative tactics. In the current US election year, he said that he foresees increased challenges at both legal and practical levels and is advising China and Chinese companies to enhance dialogue, innovate and expand globally.

Labour unions have heightened influence in the election year, Susan Schwab, a former USTR in the George W. Bush administration, said in an interview with Caixin. She described the unusual nature of the new 301 investigation, which was launched decades after the US commercial shipbuilding industry lost its global competitiveness.

The unions filing the petition for the probe are the United Steel Workers, the International Association of Machinists and Aerospace Workers, the International Brotherhood of Boilermakers, Iron Ship Builders, Blacksmiths, Forgers and Helpers, the International Brotherhood of Electrical Workers and the Maritime Trades Department, AFL-CIO.

The National Marine Manufacturers Association, which represents US shipbuilders, was not involved in the petition. The trade group’s absence reflected the decades-long decline of the US shipbuilding industry and its diminished number of members, Zhao Yifei, a professor and leader of the shipping industry research team at Shanghai Jiao Tong University, said.

“The US accounts for less than 0.1% of world shipbuilding output. China and the US shipbuilders have never been in direct competition.” — Professor Zhao Yifei, Shanghai Jiao Tong University

How US lost shipbuilding power

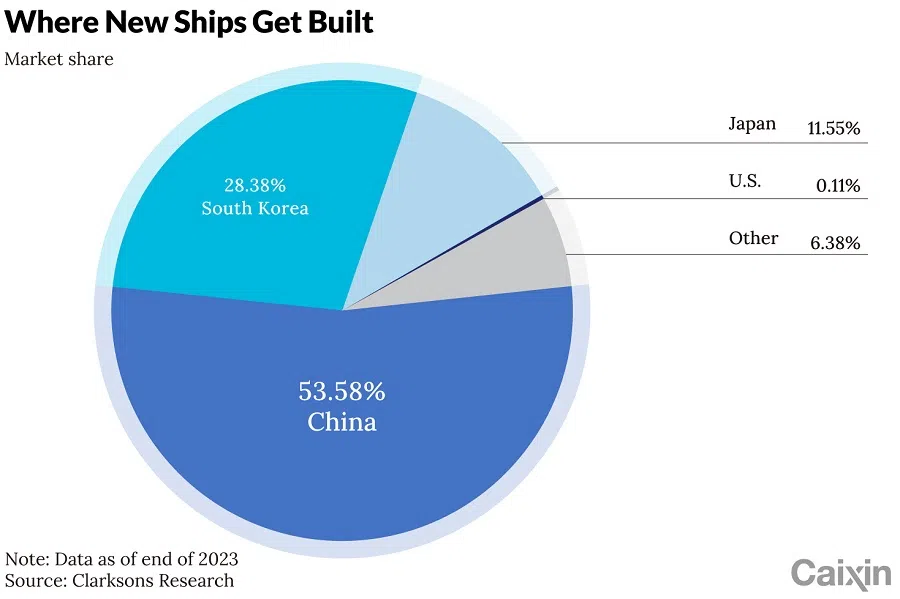

In the last two decades, China has emerged as the world’s largest shipbuilder. In 2023, the country accounted for half of global production, followed by South Korea with 26% and Japan at 14%, according to Clarksons Research, a maritime data company.

The US accounts for less than 0.1% of world shipbuilding output. China and the US shipbuilders have never been in direct competition, Zhao said.

The decline of the US industry began prior to the 1990s, independent from the rise of Chinese shipyards in the 21st century, he said.

In 2023, China exported more than half of its new seagoing vessels to Asia, followed by Europe at 9.1% and Latin America at 8.9%, according to the China Association of the National Shipbuilding Industry. Exports to the US equalled about 5% of production.

The US was a shipbuilding powerhouse during the two world wars. The industry’s decline in the world market is partly attributed to longstanding protections, such as the Jones Act passed in 1920. The law — which requires that vessels engaged in the domestic transport of goods must be built in the US and owned and crewed by US citizens — led to higher costs and reduced motivation to compete globally.

By the 1980s, with the elimination of subsidies under the Reagan administration, US shipbuilding capacity plummeted, resulting in the closure of numerous shipyards and a drop in global market share. Now the country lacks the shipyard capacity to maintain or repair its fleet of navy vessels, according to the US Naval Institute.

Various US studies show that the nation’s shipbuilders lost their competitive advantage many years ago due to over-protection, while the growth of China’s industry resulted from tech innovation and participation in market competition, as well as its fully developed manufacturing system and vast domestic market, Lin Jian, a spokesman for China’s foreign ministry, said at a press conference on 19 April. “Blaming US’s own industrial woes on China lacks a factual basis and economic common sense,” he said.

The unions’ petition calls for an assessment of a port fee on Chinese-built ships that dock at a US port and the creation of a shipbuilding revitalisation fund to help the domestic industry.

Among the more than 10,000 Chinese-manufactured cargo vessels tracked by maritime data provider Lloyd’s List Intelligence, only 9% docked at US ports between this year through 18 March.

Even if the US imposes punitive tariffs on Chinese shipbuilders, the impact is expected to be limited, several of the companies told Caixin.

The common practice among international shippers of registering their vessels in tax havens rather than the shipowner’s country... significantly complicates the task for the US in determining the country of origin and ownership of ships.

If a port fee is imposed on Chinese-built vessels, it may influence future plans by shipowners, Zhao said. Meanwhile, the increased costs would be borne mainly by international shipowners, who would oppose the fees, or lead to higher shipping expenses for US businesses, he said.

The common practice among international shippers of registering their vessels in tax havens rather than the shipowner’s country, coupled with the tendency to lease ships rather than own them outright, significantly complicates the task for the US in determining the country of origin and ownership of ships. This complexity makes it challenging for the US to collect port fees effectively.

Maritime industry experts have voiced concerns regarding the proposed port fees on Chinese-made vessels in the US. While the Section 301 investigation typically results in tariffs, current US law does not explicitly allow for such fees, making the unions’ request legally contentious, according to Zhang Chen, a senior partner at Beijing Yingke Law Firm.

Additionally, such a tax could exacerbate inflation — a scenario Biden would likely want to avoid given its political and economic implications, Zhang said.

In response to the potential new levies, China’s Ministry of Commerce has proactively engaged with major domestic shipyards to assess the impacts and countermeasures, including the formation of a specialised legal team. Zhao suggested that China should enhance dialogue with major US importers like Walmart to mitigate the potential spike in sea freight costs.

Amid a push to curb China’s manufacturing dominance, the US is courting its key allies Japan and South Korea, urging them to invest in the beleaguered US shipbuilding industry.

If the investigation results in the USTR imposing a fee on Chinese-made ships docking at US ports, China could contest the measures as discriminatory and potentially bring the issue before the World Trade Organization (WTO), said Schwab, the former USTR.

If China appeals, the WTO will most likely find that the 301 investigation violates WTO rules, said Zhang from Yingke Law Firm. But in practice, the WTO cannot take coercive measures to interfere with the US tariff measures.

Who will benefit?

Amid a push to curb China’s manufacturing dominance, the US is courting its key allies Japan and South Korea, urging them to invest in the beleaguered US shipbuilding industry.

In February, US Secretary of the Navy Carlos Del Toro met with leading Japanese and South Korean shipbuilding executives in an attempt to attract their investment in commercial and naval shipbuilding facilities in the US. During his East Asia trip, Del Toro visited the Yokohama shipyard of Japan’s Mitsubishi Heavy Industries Ltd. and the shipyards of South Korea’s Hanwha Ocean and HD Hyundai.

Hanwha Ocean’s board has approved the creation of a holding company in the US to acquire shares in overseas shipyards and maintenance service companies, according to the Korea Economic Daily.

However, reviving America’s shipbuilding industry would require closing a technological gap with Asian competitors and overcoming a dearth of domestic expertise, Zhao said.

Japanese and South Korean shipbuilders would most likely benefit from potential sanctions on Chinese-built ships, but they are unlikely to bring much-needed capital and technology to a country with a shortage of workers and unguaranteed orders, said Vincent Valentine, a transport economist at the United Nations Conference on Trade and Development.

Bao Zhiming and Luo Guoping contributed to this report.

This article was first published by Caixin Global as “Cover Story: U.S. Widens China Trade Fight to Shipbuilding Which It Lost Decades Ago”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] China’s 10 trillion RMB debt clean-up falls short](https://cassette.sphdigital.com.sg/image/thinkchina/d08cfc72b13782693c25f2fcbf886fa7673723efca260881e7086211b082e66c)