Will China’s rare earth shock tactics derail the Xi-Trump summit?

After a recent back and forth in trade restrictions, plans for a meeting between US President Donald Trump and Chinese President Xi Jinping in South Korea is now up in the air. Given the impracticality of the restrictions from both sides, Lianhe Zaobao associate editor Han Yong Hong notes that conflicts between the two must be resolved through negotiation and compromise.

Just as the US treasury secretary and Chinese academics expressed optimism that the upcoming meeting between US President Donald Trump and Chinese President Xi Jinping in Gyeongju, South Korea, at the end of the month will yield concrete results, Trump suddenly unleashed two lengthy posts on social media on 10 October.

In the first post, Trump declared that there was “no reason” to meet with Chinese President Xi Jinping. In the second, he announced that beginning 1 November, the US would impose an additional 100% tariff on Chinese exports to the US, and implement export controls on “any and all critical software”, in retaliation for what he described as China’s “hostile” restrictions on rare earth exports.

Released around noon, the first post sent US stock markets plunging. Investors were caught off guard, lamenting, “Here we go again.”

China’s rare earths card

The US–China trade truce reached in Geneva in May was declared dead, wiping out the brief optimism after the recent breakthrough in TikTok negotiations. Not only have the two countries returned to their former state of confrontation, but the standoff has escalated even further.

The implication is clear: China has found a weak spot — even a fatal vulnerability — in global high-end manufacturing (including in the US), and is ready to put the “rare earth card” in full play.

Trump’s fury was triggered by Beijing’s unprecedented tightening of rare earth export controls on 9 October. According to statements from China’s Ministry of Commerce, in addition to the seven rare earth metals announced in April, China will now include holmium, erbium, thulium, europium and ytterbium — as well as related rare earth technologies — under the scope of its export restrictions.

And that’s not the worst of it. According to another Ministry of Commerce announcement, beginning 1 December, China will impose export controls on any product manufactured anywhere in the world with more than 0.1% of Chinese rare earths. Applications to export rare earths for military uses will “in principle not be permitted”. Exports of rare earths used to research or produce chips of 14 nanometres or below, or storage chips with 256 layers or more, as well as rare earths used in equipment for the research, development or production of those two types of chips, will be reviewed on a case-by-case basis.

This is the first time China has extended export controls to cover overseas products. It remains uncertain whether China actually has the capability to enforce this kind of long-arm jurisdiction, but the posture alone is enough to shock the US.

The implication is clear: China has found a weak spot — even a fatal vulnerability — in global high-end manufacturing (including in the US), and is ready to put the “rare earth card” in full play. Where China once complained about being “choked” by US technology restrictions, it is now prepared to turn the tables and choke global supply chains.

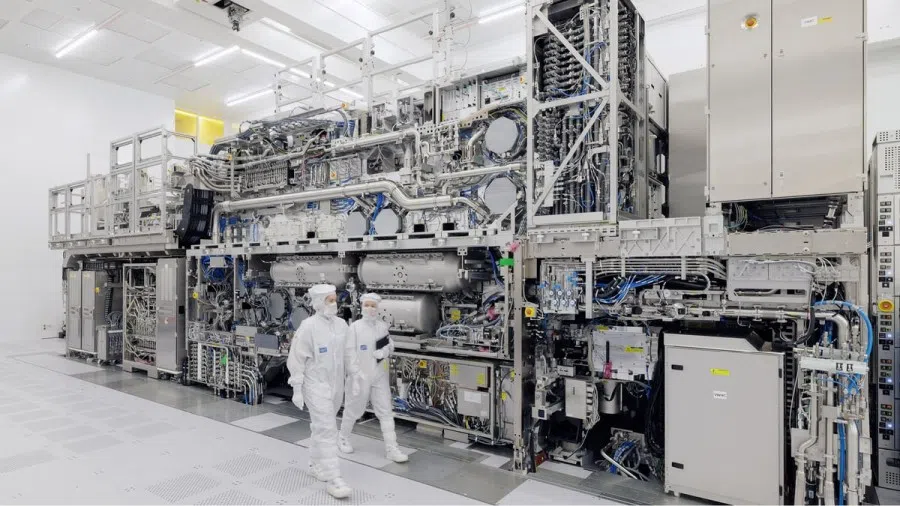

If China refuses to supply the necessary rare earth elements, ASML may not even be able to produce the machines in the first place.

Tit-for-tat counteraction

For example, Dutch lithography giant ASML’s manufacture of advanced lithography machines, which requires rare earths. The company currently must obtain the Dutch government’s permission to export such equipment to China, and with China’s new rules, in order to export its machines from the Netherlands, it would also need the approval of China — which has a near-global monopoly of rare earths exports. If China refuses to supply the necessary rare earth elements, ASML may not even be able to produce the machines in the first place.

And it is not just lithography machines. US defence contractors need rare earths to build F-35 fighter jets and several types of missiles. China’s move appears aimed at striking at the US’s vulnerabilities while also closing off loopholes that would allow the US to import Chinese rare earths indirectly through third countries.

Notably, long-arm jurisdiction and technology export controls originate from American thinking and methods. China is merely imitating, adopting a tit-for-tat approach to give one a taste of their own medicine.

Another underlying context is that since the phone call between the Chinese and US presidents on 19 September, the US has continued to introduce numerous measures targeting China. These include adding more Chinese companies to the export control entity list, extending controls to companies with 50% or more ownership by listed entities, imposing additional port fees on Chinese ships docking at US ports, as well as proposing to ban Chinese airline flights between China and the US from flying over Russian airspace.

While Chinese leaders are not in the habit of expressing their discontent on social media, this frustration is reflected in the Ministry of Commerce’s announcements.

For the Chinese leadership, these targeted actions by the various US departments were all seen as acts of betrayal and humiliation towards China. If they remain silent, it would be impossible for them to hold any China-US summit. While Chinese leaders are not in the habit of expressing their discontent on social media, this frustration is reflected in the Ministry of Commerce’s announcements.

Some analysts compared the US’s suppression of China to sprinkling pepper — applying pressure little by little across a wide surface, from the technological sanctions on ZTE in 2018, to the crackdown on Huawei and the continuous expansion of the entity list. In contrast, China’s recent strong counteraction is a sudden unprecedented escalation of unexpected intensity, imposing comprehensive controls of rare earth for both military and civilian use.

Prudent expectations

This shock is exactly what China was aiming for. WeChat public account “Chairman Rabbit” (兔主席) speculated that China is aiming to “condition” the US so that when it attempts to suppress China again, it would “reflexively” consider the consequences of China’s countermeasures — at the very least, it should make Trump realise the need to rein in the bureaucratic system “to prevent individual departments from making isolated moves”.

The account further assessed that the measures from the various US government departments against China may or may not have been known to Trump — but he certainly does not take them seriously.

It appears that China does not intend to completely sever ties with the US, but is looking to instill a sense of apprehension towards China across the entire US government.

It appears that China does not intend to completely sever ties with the US, but is looking to instill a sense of apprehension towards China across the entire US government. Judging by Trump’s reaction — he later explained to reporters that he was not calling off the meeting in Gyeongju, and that the 100% tariff on Chinese products was set to be implemented on 1 November — he is likewise leaving room for negotiation at the summit.

It seems that the fierce back-and-forth between the US and China recently are aimed at accumulating bargaining chips for negotiations. Although China has never confirmed that a presidential summit would take place, there were rumours that China has proposed an investment package worth up to US$1 trillion in exchange for the US easing national security restrictions on Chinese investments in the US, as well as reaching a “grand deal” on the Taiwan issue.

Indeed, both sides are preparing for the China-US presidential summit and targeting tangible outcomes. Conversely, just as China is unable to fully control the global export of rare earths, Trump’s intention to impose 100% tariffs on Chinese products is impractical — conflicts between the two must be resolved through negotiation and compromise.

Therefore, a presidential summit in Gyeongju remains a probable event. Xi and Trump would still engage in talks, but given the complex challenges and difficulties in China-US relations, it would be prudent not to be overly optimistic about the extent of their results, or whether they can even be implemented.

This article was first published in Lianhe Zaobao as “庆州中美元首峰会依然是大概率”.