Hong Kong’s new pivot: From Western gateway to Middle Eastern bridge

Hong Kong is embedding itself in a multipolar, collaborative network linking Asia and the Middle East, says US academic John Calabrese. For Gulf economies diversifying beyond hydrocarbons, it offers trusted legal and financial structures; for Chinese firms, a safe entry point into Middle Eastern markets; and for Gulf investors, a strategic partner facilitating informed access to Chinese assets.

The 10th Belt and Road Summit, held on 10-11 September in Hong Kong, highlighted the city’s transformation from a peripheral BRI outpost into an active partner in Eurasian connectivity. Beyond facilitating Gulf investment, trade and innovation with China and Asia, Hong Kong is now leveraging its professional services and integrated ecosystem to co-create opportunities across finance, technology, infrastructure and cultural exchange — positioning itself as a strategic bridge in multi-regional economic cooperation.

... nearly 90% of Chinese enterprises plan to expand into the Middle East, with many choosing Hong Kong as their operational base.

Strategic positioning: Hong Kong as super connector

Hong Kong’s Chief Executive John Lee has repeatedly emphasised the city’s role as a gateway between China and global markets. While historically framed in relation to Western financial centres such as London and New York, this vision has increasingly shifted towards the Middle East, reflecting Hong Kong’s active role in shaping regional partnerships rather than merely facilitating access.

A September 2025 PwC survey revealed that nearly 90% of Chinese enterprises plan to expand into the Middle East, with many choosing Hong Kong as their operational base. For Chinese firms hesitant to navigate complex Middle Eastern regulatory environments directly, Hong Kong provides not just familiar legal structures and robust banking platforms, but also strategic guidance and operational support, positioning it as a co-creator of value in regional expansion.

Reforms tied to Saudi Vision 2030 and the United Arab Emirates’ “We the UAE 2031” agenda have opened avenues for foreign firms to actively participate in local development across real estate, finance, digital innovation and cultural sectors. This bi-directional openness positions Hong Kong not as a transit hub but as a partner and stakeholder in the Gulf’s economic transformation, embedding itself in the region’s diversification strategy.

Beijing’s tightening control over Hong Kong since the 2020 national security law has reshaped the city’s autonomy and international standing, causing concern among some Western investors over legal and political freedoms. However, Gulf states have generally taken a pragmatic view, focusing on economic opportunities and access to China’s vast market.

Between 2020 and 2024, merchandise trade between Hong Kong and the GCC surged by more than 53%, climbing to nearly US$20 billion in 2024.

Bilateral trade and investment flows

Hong Kong has emerged as a key conduit for Gulf capital into Asia, but increasingly, it acts as a strategic partner, shaping investment flows and co-developing initiatives. From the agreement in October 2024 between Saudi Arabia’s sovereign wealth fund, Public Investment Fund (PIF), and Hong Kong Monetary Authority (HKMA) to jointly set up a new investment fund, to Mubadala’s stake in the Chinese AI company 4Paradigm, Gulf investors are leveraging Hong Kong’s financial ecosystem to co-create value and diversify portfolios.

Bilateral trade data affirm this intensification. Between 2020 and 2024, merchandise trade between Hong Kong and the GCC surged by more than 53%, climbing to nearly US$20 billion in 2024. Much of this trade was underpinned by re-export channels: Chinese consumer electronics, household goods and industrial materials flowed through Hong Kong’s free-port system, which now serves as both a distribution channel and a platform for strategic collaboration. At the same time, GCC output, particularly refined petrochemicals and specialty energy products, entered Asian supply chains via the same route.

Beyond trade in goods, capital flows stand out as a value-added partner. Hong Kong is now one of Asia’s premier destinations for Middle Eastern sovereign wealth funds and family offices seeking to deploy capital. The influx has been visible in initial public offerings on the Hong Kong Stock Exchange (HKEX), where cornerstone investments from Gulf institutions have exceeded US$100 million on several occasions in the past two years. The city’s appeal lies in its ability to integrate Gulf investment with China’s domestic growth while providing advisory and risk-mitigation support, rather than simply serving as a financial intermediary.

At the same time, Hong Kong companies are steadily embedding themselves in the Gulf. This expansion reflects Hong Kong’s ambition to make its corporate ecosystem part of the Gulf diversification process rather than confining it to intermediary functions.

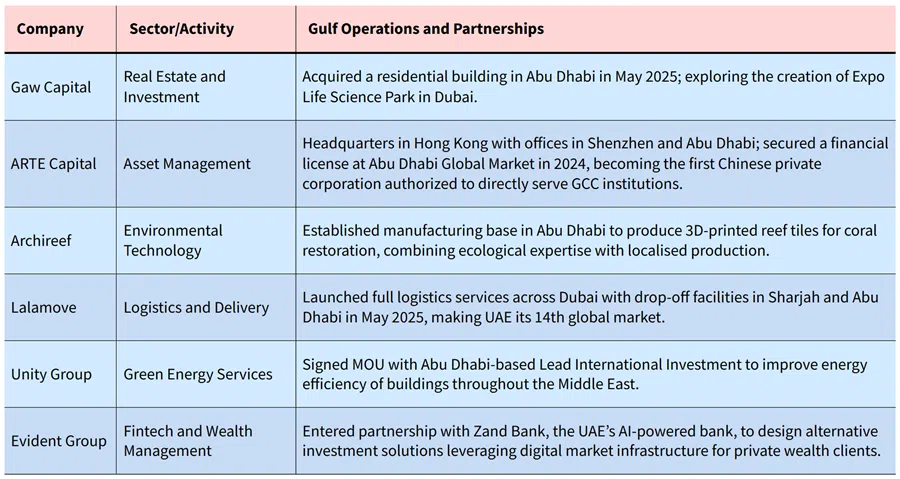

The table below illustrates selected examples of Hong Kong companies that have expanded their presence across Gulf economies, highlighting sectoral diversity:

In 2024, HKMA and Saudi Arabia’s PIF sealed an agreement to establish a joint US$1 billion investment fund.

These ventures show the diversity of Hong Kong’s corporate push into the Gulf — from finance to sustainability to logistics — all leveraging the city’s strengths in regulation and innovation to gain traction in post-hydrocarbon economies.

Financial connectivity and digital finance innovation

If trade forms the backbone of Hong Kong’s economic links with the Middle East, financial connectivity provides its nervous system. In 2024, HKMA and Saudi Arabia’s PIF sealed an agreement to establish a joint US$1 billion investment fund. The mandate is broad, covering infrastructure, green technologies and innovative ventures. The significance lies not only in the scale but in the symbolism, with one of the largest sovereign wealth players in the world directly pairing with Hong Kong’s financial regulator.

Hong Kong Exchanges and Clearing (HKEX) will soon open its first Middle Eastern office in Riyadh, ensuring that its brokerages and listed firms play an active role in shaping Saudi capital markets and cross-border investment structures.

In parallel, Project mBridge — an experiment in cross-border digital settlement using central bank digital currencies (CBDCs) — has become the leading example of Hong Kong’s role as a value-added partner in monetary innovation. Jointly initiated by HKMA, the Bank for International Settlements Innovation Hub, and various central banks, the project now includes the UAE and Saudi Arabia as active partners. For Gulf states balancing US security ties with a commercial pivot to Asia, non-dollar settlement represents a collaborative innovation opportunity, while Hong Kong advances China’s push to reduce dollar reliance.

The immediate impact was a 70% year-on-year increase in Gulf visitors to Hong Kong in 2024, followed by another 50% rise in the first seven months of 2025.

Through these initiatives, finance emerges not merely as a sector but as the area where the partnership between Hong Kong and the Gulf is most visibly co-creating new Eurasian economic architectures.

Visa waivers boost HK-Gulf ties

Transforming individual deals into lasting relationships requires institutional frameworks, and Hong Kong has invested considerable political capital in this domain. Over the past two years, the city has signed Memoranda of Understanding (MOUs) with Saudi Arabia, Oman and the UAE designed to strengthen joint investment facilitation, regulatory coordination and arbitration mechanisms.

Hong Kong is preparing to open a new Economic and Trade Office in Riyadh, expanding its role as an on-the-ground partner in governance and investment implementation, complementing its existing network in Dubai, Cairo and Izmir.

Mobility enhancements have played a complementary role. In October 2024, Qatar granted visa-free access to Hong Kong SAR passport holders, and in May 2025 both Qatar and the UAE upgraded their visa waivers, significantly easing travel. The immediate impact was a 70% year-on-year increase in Gulf visitors to Hong Kong in 2024, followed by another 50% rise in the first seven months of 2025. The institutional integration of travel and investment policies enables Hong Kong to co-shape regional engagement, not just facilitate it.

Sporting events and exhibitions allow Hong Kong to actively project a shared identity with Gulf partners, moving beyond transactional economic ties.

Culture, tourism and soft power dimensions

Economic ties are increasingly accompanied by cultural diplomacy. Sporting events and exhibitions allow Hong Kong to actively project a shared identity with Gulf partners, moving beyond transactional economic ties.

In August, Hong Kong hosted the Saudi Super Cup, providing a symbolic signal of Middle Eastern commitment to embed their sporting diplomacy in Asian markets. Saudi-backed LIV Golf recently revealed plans for its first title-sponsored tournament, set for next year. These initiatives are more than entertainment; they announce Middle Eastern presence in Hong Kong’s cultural scene and, reciprocally, expose Hong Kong audiences to aspects of Gulf identity.

At the same time, exhibitions of Islamic art have enriched Hong Kong’s museum and cultural spaces, broadening local awareness of Arab and Muslim heritage. The first major Islamic art exhibition in Hong Kong, Wonders of Imperial Carpets: Masterpieces from the Museum of Islamic Art, Doha, runs 18 June-6 October at the Hong Kong Palace Museum. Tourism strengthens community and cultural integration. The surge in Gulf visitors not only boosts hotels and retail but reflects Hong Kong’s role as a co-participant in cross-cultural exchange.

The announcement that EAP Technology Expo, the Middle East’s largest tech fair, will stage its first overseas edition in the city in 2026 underscores the city’s role as a collaborative tech partner and Asian innovation hub.

These cultural and tourism elements perform three overlapping functions. They intensify people-to-people exposure, enhance tourism demand at a time when Hong Kong is diversifying its visitor sources, and, finally, help reshape Hong Kong’s international identity. Rather than being seen predominantly as a bridge to the West, Hong Kong is now also recognised as an Asian hub interlaced with the Gulf and broader Islamic world.

Broader implications for relations with the Middle East

The intensification of Hong Kong-Gulf ties cannot be separated from Beijing’s strategic realignment. Since the mid-2010s, China has deepened partnerships with Gulf monarchies through the Belt and Road Initiative, major infrastructure contracts, energy cooperation, and, more recently, high-profile diplomatic roles such as brokering Saudi–Iran rapprochement in 2023. Yet state-to-state relations alone are insufficient; sustained connectivity requires partners who can actively manage capital, operations and risk, which is where Hong Kong’s value-added role emerges.

Hong Kong functions as a financial conduit, regulatory and legal gateway, innovation hub, and soft power bridge — actively shaping regional economic and cultural ecosystems. These roles reinforce China’s multipolar vision while offering Gulf partners privileged access to China in a collaborative framework.

Middle Eastern elites appear more pragmatic, prioritising investment value and diversification over political concerns. But US-China tensions could limit how far Gulf sovereigns publicly lean on Hong Kong.

Still, risks remain. The 2020 national security law complicates perceptions abroad. Western investors have adjusted their engagement cautiously. Middle Eastern elites appear more pragmatic, prioritising investment value and diversification over political concerns. But US-China tensions could limit how far Gulf sovereigns publicly lean on Hong Kong. Moreover, Hong Kong faces competition from Singapore, whose stable regulatory environment and Southeast Asia ties offer alternative value-added pathways.

Towards a new arc of connectivity

Hong Kong’s ties with the Middle East, most notably with the Gulf countries, have evolved into a multi-dimensional partnership that is co-creating value across finance, trade, technology, tourism and culture. Official visits, new trade offices and MOUs institutionalise cooperation, while sovereign wealth inflows, IPO participation, visa waivers and cultural exchanges enhance collaborative impact beyond pure economics.

Hong Kong anchors the Eurasian connectivity arc envisioned by Beijing. For Gulf economies diversifying beyond hydrocarbons, it offers trusted legal and financial structures; for Chinese firms, a safe entry point into Middle Eastern markets; and for Gulf investors, a strategic partner facilitating informed access to Chinese assets.

By redefining its orientation away from reliance on transatlantic flows, Hong Kong is embedding itself in a multipolar, collaborative network linking Asia and the Middle East. If trends continue, it may emerge as a 21st century pivot city — standing at the intersection of East and West, North and South, China and the Middle East, finance and culture.