China’s microdrama mogul: How COL is conquering global screens from Singapore

Digital content company COL (中文在线) has made its name as a popular microdrama platform in China, and now it is leveraging Singapore as its international business hub to expand its microdrama offerings globally. Lianhe Zaobao journalist Thomas Li Tao speaks with COL president Tong Zhilei to find out more.

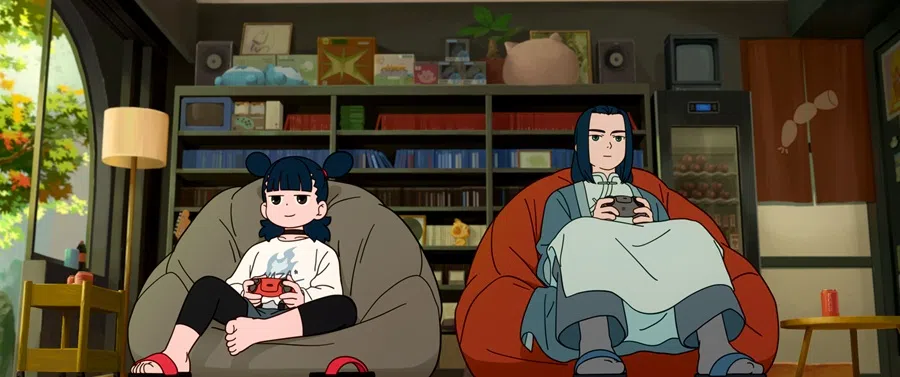

Since its release in China in July 2025, the animated movie The Legend of Hei 2 has grossed nearly 390 million RMB (US$54.8 million) at the box office in just one month. It scored a high rating of 8.7 out of 10 on China’s online platforms, surpassing even that of the immensely popular Ne Zha 2.

Beyond the Chinese market, this animated movie premiered in Malaysia, with plans for release in South Korea, Japan and Singapore.

In fact, when The Legend of Hei was released outside China in 2019, it grossed about 560 million yen (US$3.9 million) at the box office in Japan, setting the record for Chinese animated movies overseas at the time.

COL (中文在线, zhongwen zaixian), a listed Chinese company, is behind this well-known intellectual property (IP). In 2023, COL’s president Tong Zhilei spotted this IP’s blockbuster potential and acquired 51% of animation studio Hanmu Chunhua (HMCH, 寒木春华), the creator of The Legend of Hei, for about 140 million RMB.

While COL’s Chinese name includes the phrase “Chinese language” (zhongwen), Tong repeatedly emphasised “international strategy” during our interview. He said, “Our four strategic pillars include ‘prioritise international business’, and international business is extremely important in our overall corporate strategy.”

The node of this international strategy is Singapore.

“Singapore has a lot of amazing cross-cultural talent, especially people who really get Chinese culture.” — Tong Zhilei, President, COL

Banking on Singapore’s cross-cultural talents

In 2022, having assessed numerous locations outside mainland China, COL decided to set up its international business headquarters in Singapore. “In fact, Southeast Asia can be said to be the only region in the world where the online market is still growing. I think Singapore is the top choice to reach out to the entire region,” Tong said.

In addition to Singapore’s low-tax environment and its unique positioning in a complex global landscape, Tong believes that talent is another critical reason. He said, “Singapore has a lot of amazing cross-cultural talent, especially people who really get Chinese culture. At the same time, we’re counting on international talents with global experiences — those who can connect across different cultures and speak multiple languages.”

However, Singapore is not a market traditionally known for highly developed cultural industries. Just two weeks prior to the interview, mm2 Asia announced the closure of all Cathay Cineplexes. Before that, The Projector that screened independent films also shut down. Would this affect the confidence in investing in Singapore’s cultural industries, especially in bringing movies to Singapore?

Tong responded to the question head-on, “We chose to come to Singapore because we hope to lend some impetus to further develop the local cultural industries. Of course, I also sincerely hope that the Singapore authorities can provide more support and emphasis for the cultural sector.”

“Since releasing microdramas, they account for 40% of our revenue and are the fastest growing product, and may possibly be nearly the top single product.” — Tong

Shift from digital publishing to microdramas

Although the company first began with digital publishing, microdramas have been COL’s focus for the past three years and its main overseas product.

Founded in 2000, COL was one of China’s earliest and largest digital publishing platforms with more than 4.5 million writers and 5.6 million works in its stables. After listing in 2015, the company promoted integrated IP development, adapting works into audiobooks, TV dramas and animations.

Microdramas have rapidly become a pillar of COL’s business since the company embarked on producing them in 2021. Tong said, “Since releasing microdramas, they account for 40% of our revenue and are the fastest growing product, and may possibly be nearly the top single product.”

COL’s business transformation may also reflect Tong’s own unconventional journey. After studying diligently to enroll in Tsinghua University, he graduated with triple degrees in automotive engineering, law and management, and was recommended by China’s Ministry of Education to pursue Tsinghua University’s International Master of Business Administration programme.

... after the rapid dot-com bust in the early 2000s, Tong lost control of his company. Undeterred, he bought it back three years later and embarked on a second entrepreneurial journey.

Life seemed smooth sailing for Tong, and he formed a team that won more than 6 million RMB in venture capital in a 1999 startup competition, which led to the founding of COL. Tong thus became one of the first graduate entrepreneurs in China.

However, after the rapid dot-com bust in the early 2000s, Tong lost control of his company. Undeterred, he bought it back three years later and embarked on a second entrepreneurial journey.

Untapped potential in Southeast Asia

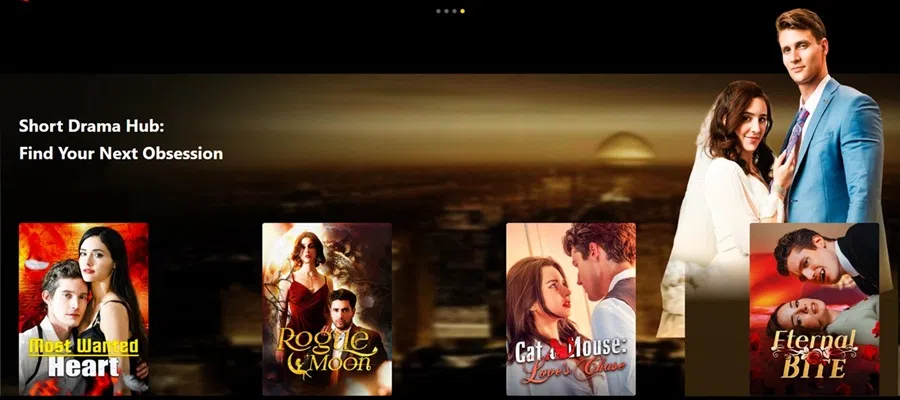

The wave of microdramas in overseas markets has helped FlareFlow, COL’s platform, to climb to the top of both the free-to-download iOS and Google Play entertainment app charts in the US within five months of its launch.

Tong said that this flagship microdrama platform is a company registered in Singapore. “From this perspective, we are extending coverage to the world from Singapore,” he added.

... the market will develop very rapidly and the audience for microdramas will be everyone — male and female, teenagers or seniors in their 50s and 60s, and across all ethnic groups... — Tong

Currently, consumers of microdrama in Southeast Asia are mainly young women, but Tong emphasised that this is only temporary. “While young women are today’s microdrama consumer demographic, the market will develop very rapidly and the audience for microdramas will be everyone — male and female, teenagers or seniors in their 50s and 60s, and across all ethnic groups,” Tong explained.

Relative to other markets, Southeast Asian users are highly active but have limited spending power. “Compared with the US market, Southeast Asia’s average revenue per user is lower. US users willingly pay more to watch microdramas, but Southeast Asian users prefer some free content, so we will adopt different pricing strategies,” Tong elaborated.

Using generative AI to create microdrama scripts

Tong said that microdramas are priced around US$0.50 per episode in the US, and “a drama series may comprise 50 to 100 episodes, with each episode at one to three minutes”. Currently, COL offers both monthly subscriptions as well as payments by episode or series.

He emphasised that AI is another major strategy and added, “We have launched our own AI tools as early as 2021. At that time, we used AI technology for text-to-speech, like in broadcasting.”

In 2023, COL launched its large language model Xiaoyao (中文逍遥) that generates stories and scripts. “We can use AI to create content within a short time, experimenting especially for some short videos. However, we are still unable to rely entirely on AI to produce all content and drama series at this stage,” Tong added.

He revealed that COL is also using AI to produce animations, which have been released on Singapore Mediacorp’s mewatch platform.

Expanding user coverage and diversifying content and formats

The microdrama market may look very promising and be well-received, but is it commercially viable?

DataEye statistics show that in the first half of 2025, 309 microdrama apps were launched outside China, up 110% year-on-year, with about 27 new microdrama apps launched every month...

According to COL’s latest earnings report, it has posted a loss of 226 million RMB in the first half of 2025, its sixth consecutive quarterly loss. Its expenditure on sales has risen 40% year-on-year, mainly due to increased spending on overseas promotion. Its Singapore subsidiary, FlareFlow, accounts for 20% of overall net profit.

As profitability proves challenging, the market has become increasingly crowded. DataEye statistics show that in the first half of 2025, 309 microdrama apps were launched outside China, up 110% year-on-year, with about 27 new microdrama apps launched every month, many of which are backed by Chinese capital.

Nonetheless, Tong believes that the outlook for microdrama platforms in the coming years remains very promising, describing it with the Chinese idiom “flourishing but not yet at its peak” (方兴未艾).

“Despite the rapid growth of the market, there remains a vast number of untapped users. For example, the percentage overlap between Netflix users and microdrama viewers is only in the single digit, which implies that there are 90% of potential viewers we can still reach out to,” he explained.

... in future, viewers may even upload their own photos to insert themselves into the drama to “become the protagonists”.

Beyond user numbers, the other important areas to develop are content types and product formats.

Tong said, “Content will become more diverse. Currently, microdramas may mostly be romance-themed, but there will be other genres in future, including history, science fiction and war. There will also be more innovative formats, for example, interactive presentations that allow viewers to decide on the plot instead of only passively viewing.” He added that in future, viewers may even upload their own photos to insert themselves into the drama to “become the protagonists”.

Tong said that Singapore’s position as the headquarters for the company’s international business will be further enhanced, and “international business is expected to grow very quickly this year, possibly reaching 30% to 40% of total business revenue”. He hopes that international business will eventually account for more than 50%.

“We believe that the market for microdramas will definitely grow by more than an order of magnitude, as this is not merely a business but a new form of cultural expression,” he added.

This article was first published in Lianhe Zaobao as “中文在线总裁童之磊:借新加坡之力 推动微短剧走向世界”.